. . brings a decentralized and democratic economic platform to the real economy! . . brings a decentralized and democratic economic platform to the real economy! |

||||||

Cloud Capital Chamber of Economies Cloudfunding CloudfundMe Buyers Crowd Sellers P2P Groups Places SignUp GOMTX DOMIndex Free Economic Value Economic Engine Smart Contracts UDC Direct Foreign Decentralized Capital PriceDemand |

||||||

|

||||||

|

||||||

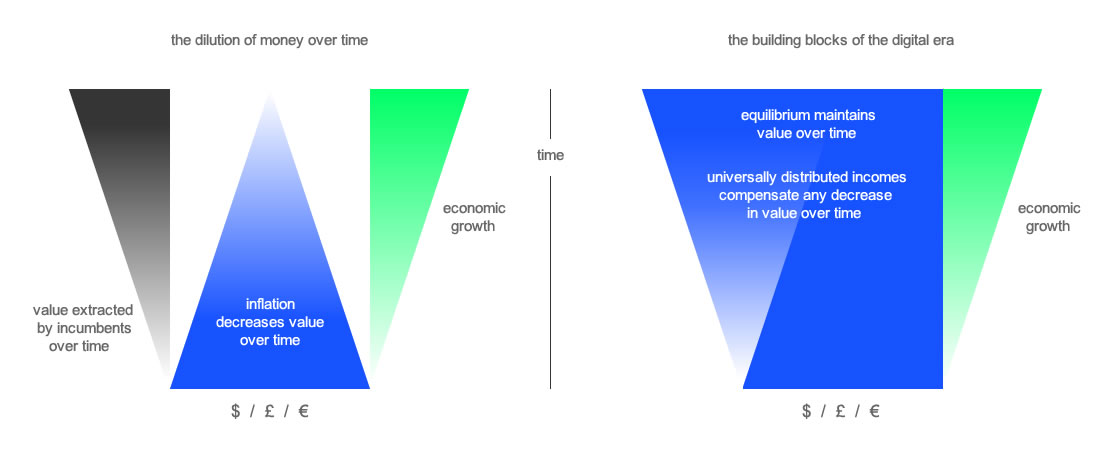

| Inflation is only a compensation for financial extraction With the way the economic cycles have been defined over the last hundred years or so, and more so in the last decades, with the closer cooperation between countries, much of the growth of an economy comes down to controlling inflation. It's the controlling of the money supply by central banks and incumbent banks that adjust the flow of the money supply using interest rates, by increasing rates it discourages activity or decreasing rates, it in theory, encourages activity. Growth in any economy is important for the forward movement of development, from the government down to the general population who benefit from the stimulation brought about by supply chain activity through to the end consumer. The positives are that the activity spreads the supply of money out to those who participate in the activities directly, and those that rely on the activity further down the line, activity of any kind usually helps add value to the local governments with tax revenues. The negatives have shown that too much supply of money can eventually expand rapidly and inflate the prices of products and services, when that happens the value of the currency has a reduced buying power, if it goes too far it can result in the collapse of a market(s) or cause a wider recession. Inflation causes currencies to lose value by default What doesn't always get shown is how the value of currency itself can lose so much buying power, as prices increase ( via inflation ) - when the economy is moving along, the balance in compensation is usually overcome by the 'return on Capital Investment' from money placed in an institution like a bank, to gain interest, or even by being a shareholder of the bank and reap the benefit in dividends from the banks profits in controlling the money supply. Every amount of compensation via interest or dividends paid out adds to the speed in the dilution of the value and buying power of the currency - the greater inflation with price increases like in food or real estate means the more compensation that is gained by those close to the money suppliers - this is simply how the Old Economy has functioned to spread wealth to those that closely followed the money supply. By the time that the reoccurring recessions come around, the compensation has already been distributed, leaving prices to collapse, debts to repay and the value of the currency worth less, and a restart of the cycle begins. The GFC outcome was the compensation to the 'money suppliers' at full throttle, and there's still no hand brake - it's still the case of, 'the fox looking after the chickens'. Compensation in the Digital Era is universally distributed Technology is now able to provide a new paradigm that transitions economies to a better balance between inflation and deflation. The value of currency when it can be maintained at an equilibrium without inflation or deflation, and not lose buying power value over time, is able to build prosperity much faster and compete globally with a much stronger and stable currency. The ComTechX Industry has the technology to have economic growth and be capable of distributing compensation from local productivity on a global scale, without reducing the value of local currencies - with an Online medium of exchange. Localization provides the environment to build on local industries using Cloudfunding and Outsourced Selling to have defendable advantages, while providing better pricing for the consumers and adding to the distribution of wealth through location activity. The velocity of productivity and having the benefits of a Cashless World that doesn't get involved with the banking systems means that there is zero costs that need to be added to product prices, it perpetually motivates local productivity with incentives When local activity is generated there is a LAT - Location Activity Tax that is collected and then distributed globally to all the global population that is linked to the location - this distribution adds to the universally distributed income as additional buying power. The adding to the individual members means that inflation is not needed to increase prices to compensate for the losses typically extracted by the incumbents in the old economy. Change will have profound and direct results The approach by ComTechX is to move away from the costly way to help economies by supporting the money suppliers, then gaining from the profits they gain from their control over the supply of money to other members of society - what can now be done is be pro-active in backing local businesses and industries directly and gain from the better prosperity that those businesses can generate in real-time in the local economies. It makes little sense to back the money supplier when all they're doing is cycling money through a control mechanism that extracts more and more value, decreasing the value of money over time, it only provides 'boom and bust' economics, and an easy escape for those that extracted the value along the way. ComTechX has the technology today to give everyone the opportunity to directly help stimulate productivity in a local region, city, suburb or business, providing the needed flow of value to directly generate the velocity of value within their own communities. The transition of advertising, from being part of the mechanics of Commerce, to its distribution as Free Economic Value, and its validation as free working capital tied to genuine Global Productivity in the Supply and Demand of products and services, through to its final validation as a neutral global Digital Trading Cash - key to the ongoing perpetual flow of economic growth in the New Economy. The bottle-neck between the banking industry controlling the money supply and the general population has no future in the Digital Era, not now that technology can provide all the control that's needed to indelibly ( binary ) link the flow of value with productivity, and have it all controlled in real-time by a global democratic consensus. The change of how markets will work, comes with the change in how influence and value cross borders to stimulate local economies by the actions of local Sellers using free Direct Foreign Decentralized Capital - Cloudfunding does the rest. . . a clear Run-Way With the resources to operate the Cloudfunding Platform coming from reinventing Commerce, it gives the future of Digital Monetization a clear Run-Way to scale with unlimited resources. Those resources are now made available as Free Economic Value that the Global Crowd can use to build their own financial freedom by earning as an Open Market Maker - OMM. This freedom can be wide ranging, some areas where it can help is where people have had to travel to other countries to work for better pay, as Foreign Domestic Workers - FDW. Cloudfunding offers a double win for foreign workers, there's the free way to send digital cash back home and the other is building a business as a Global Crowd member in any spare time, to multiply the way of earning better incomes. Cloudfunding is structured to legitimately clear borders to work in economies for the benefit of Consumers, Enterprises and Governments. Cloudfunding has a beneficial digital contagion that spreads Global Productivity Wealth to all corners of the global, where an individual can now use a mobile phone to be a Global Citizen. Change to solving inequality ComTechX approaches the issues of incentivizing smallholder farmers and traders, as well as other businesses further along the Supply Chain with Free Economic Value, which can move freely across borders as Direct Foreign Decentralized Capital - DFDC. It offers the full package of what foreign aid and banking can't achieve because of their top down approach that can get lost and not filter down, and the predatory methods that exist with banking that only use selective business methods and not humanitarian. |

||||||

|

|

|||||

|

||||||

|

||||||

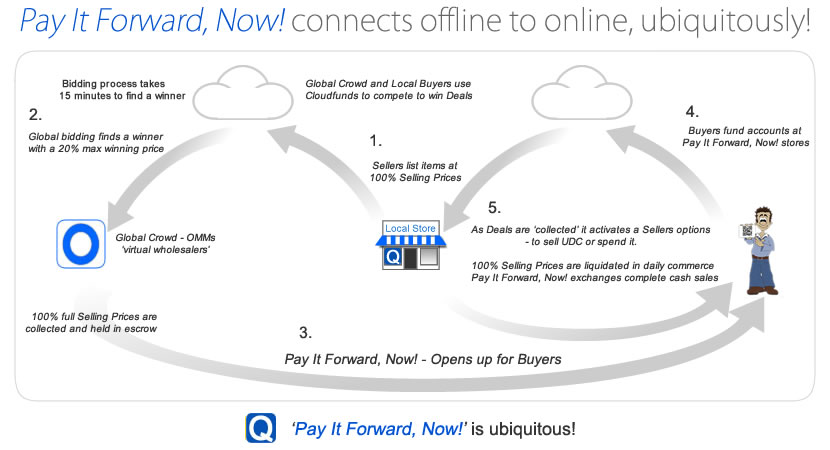

Check out a Deal Registration and Cloudfund Strategy See a Snap-Shot view of a Cloudfund strategy and bidding for Deals Cloudfunding generates Price Demand - digitizes 'cash' to flow ubiquitously around the world What's The Monetizing Moment? Cloud Commerce operates by Outsourcing the Selling to the Crowd by Cloudfunding How Sellers Outsource their Selling to the Crowd? |

||||||

As UDC is validated and exchanged in the Digital Economy it permeates out into local economies! see the connection of players that help achieve 'Productivity' : Global Cloud Productivity Wherever your Location is - you are not alone! |

||||||

| Join the Crowd that's going to get it right - get updates about the coming launch! | ||||||

| About Us Contact Privacy Policy Terms of Service |

||||||